Both CAGR (Compound Annual Growth Rate) and XIRR (Extended Internal Rate of Return) are used to measure investment returns over time, but they differ in how they handle cash flows and investment timing.

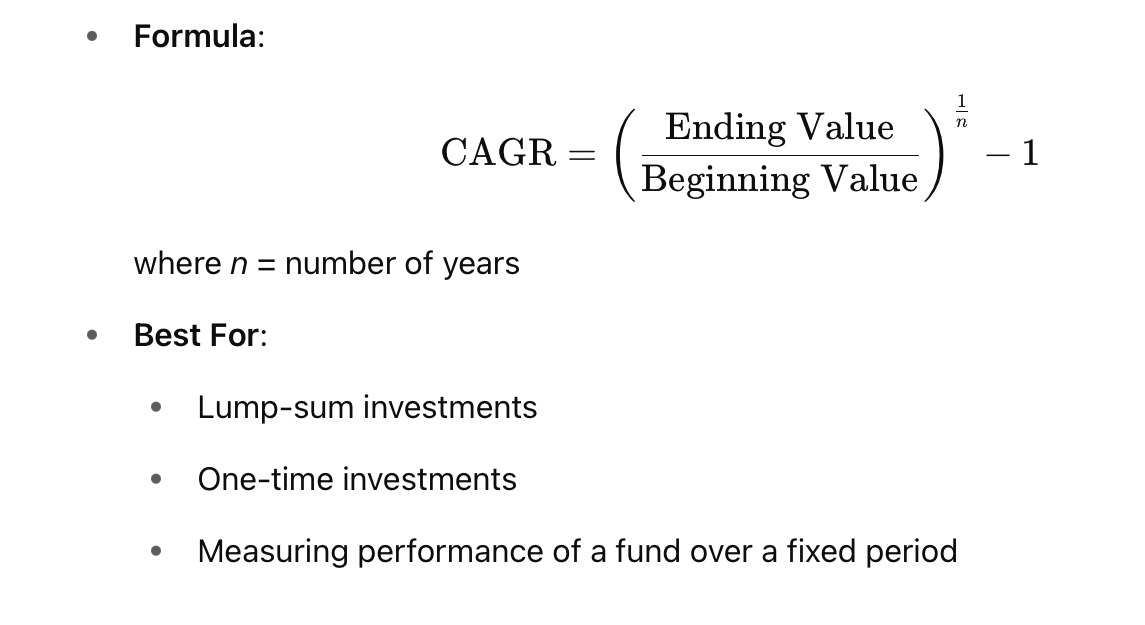

Definition: Average annual growth rate of an investment assuming it grows at a constant rate and is compounded yearly.

Definition: A more flexible IRR calculation that accounts for multiple cash flows at irregular intervals (like SIPs, withdrawals, partial redemptions).

Used in: Excel/Google Sheets to calculate returns for complex cash flows.

Best For:

| Feature | CAGR | XIRR |

|---|---|---|

| Cash Flows | Single (lump sum) | Multiple, irregular |

| Time Periods | Assumes constant time intervals | Handles irregular timing |

| Real-Life Use | Lump-sum mutual fund returns, stock holding | SIP, rental cash flows, mutual fund statements |

| Accuracy (for complex cases) | Less accurate | More accurate |

| Used In | Reports, annual returns | Excel, investment trackers |

Example

You invest ₹1,00,000 for 5 years → ending value ₹1,61,051

→ CAGR = 10%

You invest ₹10,000 every month for 5 years → ending value ₹8 lakh

→ Use XIRR to calculate exact return based on every inflow

Comments

Write Comment