ABOUT National Securities Depository Limited (NSDL)?

Established in 1996, NSDL is India's first and largest securities depository, playing a pivotal role in the dematerialization of securities and facilitating electronic settlement of trades. It offers a range of services including account maintenance, dematerialization, corporate action processing, e-voting, and consolidated account statements.

As of March 31, 2025, NSDL (National Securities Depository Limited) reported 39.45 million (3.945 crore) active demat accounts, marking a significant increase from the 31.46 million accounts recorded on March 31, 2023. These account holders are distributed across more than 99% of India's pin codes and in 186 countries worldwide, highlighting NSDL's extensive reach and its pivotal role in India's financial infrastructure.

IPO Snapshot

- Issue Type: Offer for Sale (OFS)

- Total Shares Offered: 50.15 million equity shares (revised from 57.26 million)

- Estimated Issue Size: Approximately ₹3,000 crore (down from ₹3,500 crore)

- Face Value: ₹2 per share

- Price Band: To be announced

- Lot Size: To be announced

- IPO Opening & Closing Dates: To be announced

- Listing Exchange: BSE

- Book Running Lead Managers: ICICI Securities, Axis Capital, SBI Capital Markets, HDFC Bank, HSBC Securities, Motilal Oswal, IDBI Capital

Shareholding and Offer Details

The IPO is entirely an Offer for Sale by existing shareholders to comply with SEBI's 15% ownership cap in Market Infrastructure Institutions (MIIs). Key shareholders participating in the OFS include:

- IDBI Bank: 22.22 million shares (11.11% stake)

- National Stock Exchange (NSE): 18 million shares (9% stake)

- State Bank of India (SBI): 4 million shares

- HDFC Bank: 2.01 million shares

- Union Bank of India: 0.5 million shares (reduced from 5.625 million)

- SUUTI (Specified Undertaking of the Unit Trust of India): 3.415 million shares

Financials Of NSDL

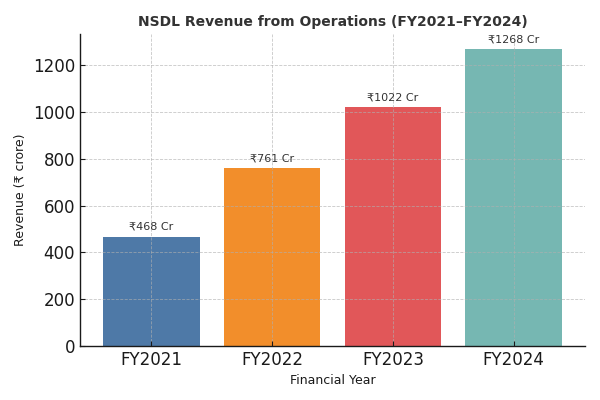

Revenue from Operations

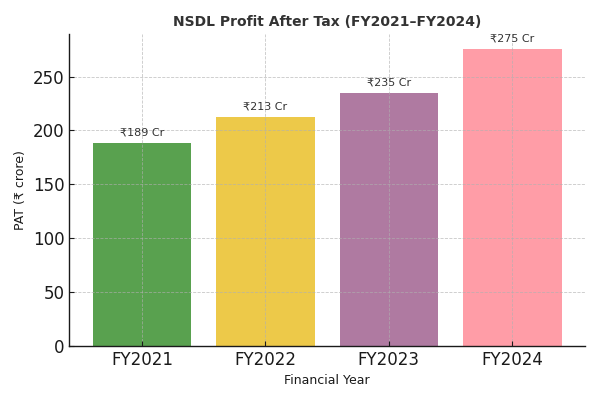

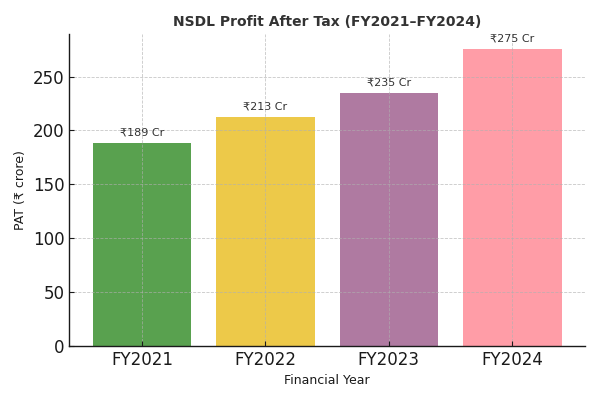

Profit After Tax (PAT)

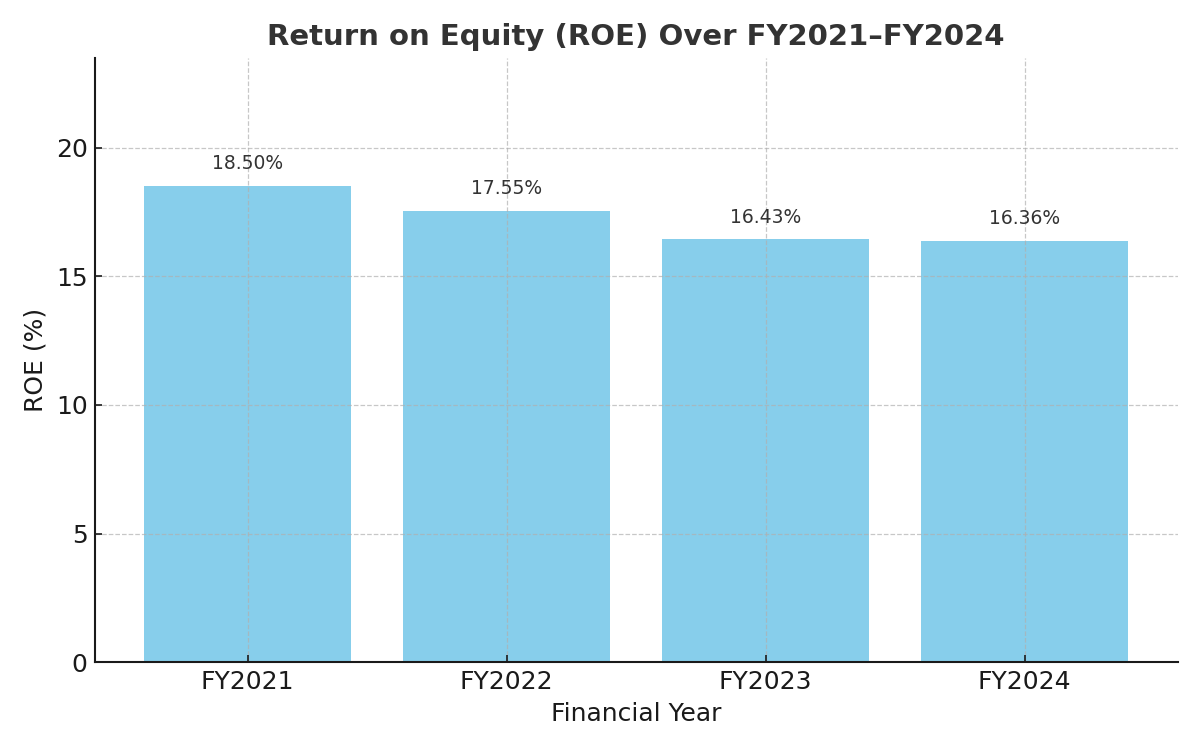

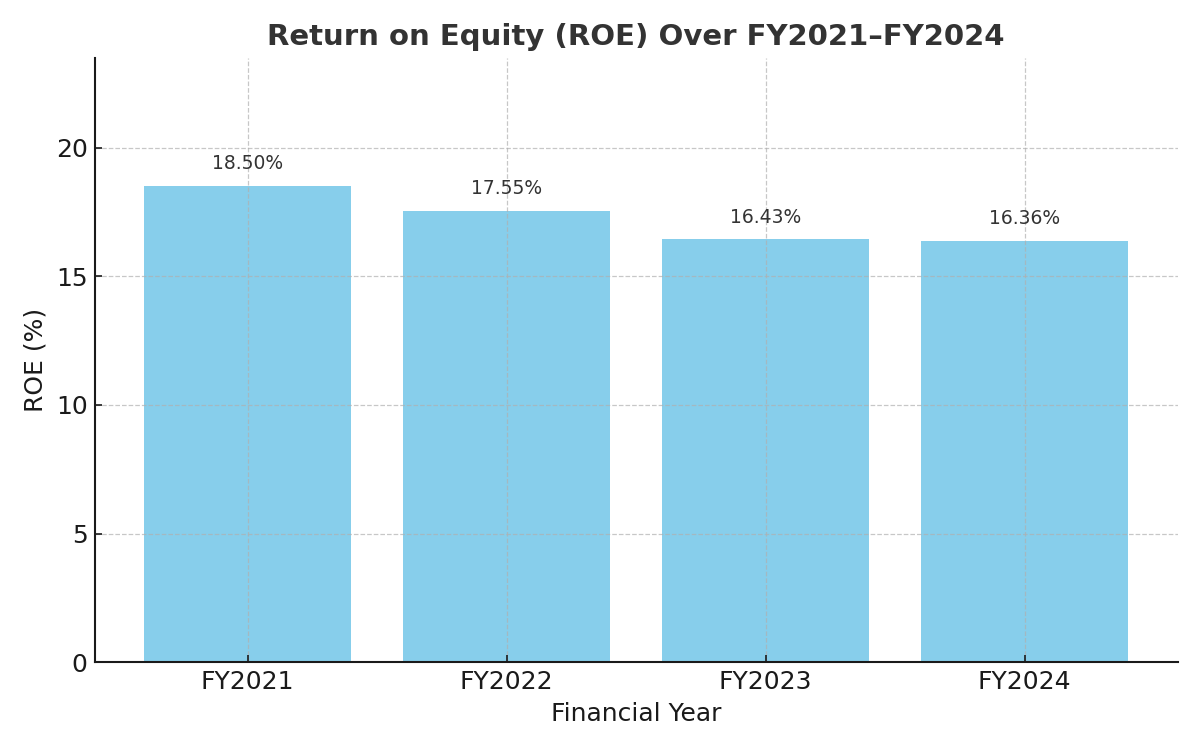

Return on Equity (ROE)

Approximately 37.3% of the FY2024 revenue was derived from depository services, highlighting NSDL's core business strength .

Key Strengths of NSDL

- Market Leadership: NSDL is the largest depository in India by number of issuers, active instruments, and value of assets under custody.

- Technological Infrastructure: Pioneered dematerialization in India and continues to invest in cutting-edge technology for secure and efficient operations.

- Extensive Reach: Presence in over 99% of Indian pin codes and services extended to 186 countries.

- Stable Financial Performance: Consistent growth in revenue and profits over the past few years.

Risks & Considerations

- Regulatory Environment: As a Market Infrastructure Institution, NSDL operates under stringent SEBI regulations.

- Competition: Faces competition from other depositories like Central Depository Services Limited (CDSL).

- Technological Risks: Dependence on technology makes it susceptible to cybersecurity threats and system failures.

COMPARISON ON NSDL AND CDSL

Financial Overview (FY2024–25)

| Metric |

NSDL |

CDSL |

| Revenue |

₹1,268.24 crore |

₹1,199 crore |

| Profit After Tax (PAT) |

₹275.40 crore |

₹526 crore |

| Operating Margin |

~25% |

~57.5% |

| Return on Equity (ROE) |

~16.36% |

32.6% |

| Dividend Payout Ratio |

~7.3% |

54.8%

|

Market Share & Demat Accounts

| Metric |

NSDL |

CDSL |

| Active Demat Accounts |

~3.91 crore (as of Feb 2025) |

11.56 crore (as of FY2024) |

| Market Share (Accounts) |

~24% |

~76% |

| Assets Under Custody |

₹398 lakh crore |

₹64 lakh crore |

Note: NSDL holds a larger share in terms of asset value, while CDSL leads in the number of demat accounts.

Business Model & Clientele

- NSDL: Primarily serves institutional clients such as mutual funds, foreign institutional investors (FIIs), insurance companies, and pension funds. It is the preferred platform for handling corporate bonds, government securities, commercial papers, and certificates of deposit.

- CDSL: Focuses on retail investors, offering services like e-KYC, e-voting, and dematerialization of unlisted shares. Its growth is driven by the increasing number of retail participants in the Indian stock market.

Operational Highlights

| Feature |

NSDL |

CDSL |

| Promoter |

National Stock Exchange (NSE) |

Bombay Stock Exchange (BSE) |

| Year of Establishment |

1996 |

1999 |

| Listing Status |

Unlisted (IPO expected in 2025) |

Listed on NSE since 2017 |

| Technological Services |

Advanced services for institutions |

Retail-focused digital services |

Key Takeaways

- Profitability: CDSL exhibits higher profitability metrics, including a superior PAT and ROE, attributed to its retail-centric model and efficient operations.

- Market Penetration: CDSL leads in the number of demat accounts, reflecting its strong presence in the retail segment. NSDL, however, manages a larger volume of assets, indicating its dominance in institutional holdings.

- Dividend Policy: CDSL has a more investor-friendly dividend policy, distributing a significant portion of its profits, whereas NSDL retains most of its earnings for reinvestment.

- Growth Prospects: CDSL's growth is propelled by the surge in retail investors, while NSDL's future expansion may hinge on its upcoming IPO and continued focus on institutional services.

Comments

Write Comment