A Fiscal Survey is an examination and analysis of a government's fiscal policies, practices, and financial management. It involves a comprehensive review of the government's revenue collection, expenditure patterns, budgetary allocations, and overall fiscal health.

The goal of a fiscal survey is to assess the effectiveness, efficiency, and sustainability of a government's fiscal policies and to provide recommendations for improvement.

Here are some potential benefits that a fiscal survey can bring:

Evaluation of Fiscal Health: A fiscal survey helps evaluate the overall fiscal health of a government by examining its revenue sources, expenditure patterns, and debt levels. It provides insights into the government's financial stability and sustainability.

Efficiency and Effectiveness: It allows for an assessment of the efficiency and effectiveness of public spending. This includes analyzing whether resources are allocated appropriately and whether public funds are being used efficiently to achieve desired outcomes.

Policy Evaluation: A fiscal survey helps evaluate the impact of existing fiscal policies. By assessing the outcomes of past policies, policymakers can make informed decisions about whether adjustments or reforms are needed to better achieve economic and social goals.

Debt Management: It assists in evaluating the government's debt management practices, including the level of public debt, its composition, and the sustainability of debt levels over time. This is crucial for ensuring long-term fiscal stability.

Revenue Structure: The survey examines the sources of government revenue to determine the reliability, stability, and fairness of the tax system. It helps identify opportunities for revenue diversification and potential reforms in tax policies.

Transparency and Accountability: Conducting a fiscal survey enhances transparency and accountability in government finances. It provides a basis for public scrutiny and allows citizens to understand how their tax money is being utilized.

Policy Recommendations: Based on the findings of the survey, policymakers can receive recommendations for improving fiscal policies, enhancing revenue generation, controlling expenditures, and achieving better fiscal outcomes.

Long-term Planning: A fiscal survey aids in long-term planning by providing insights into the sustainability of current fiscal policies. It helps governments anticipate and address potential challenges, such as demographic shifts or economic fluctuations.

International Comparisons: Governments can use fiscal surveys to compare their fiscal performance with that of other countries, gaining insights into global best practices and identifying areas for improvement.

Investor Confidence: A well-conducted fiscal survey can contribute to building investor confidence by demonstrating a government's commitment to sound fiscal management, transparency, and accountability.

In summary, a fiscal survey is a valuable tool for assessing and improving a government's fiscal policies, promoting transparency, and ensuring the long-term sustainability of public finances.

Subscribe to Zinkpot Capital on YouTube for videos and more such content.Click here

Ask Anything, Know Better

17 hours ago Double deflation is a method whereby gross value added (GVA) is measured at constant prices, which is the price at the base year. For India, base year for GVA calculation is 2011-12. In Double deflation, GVA is obtained by subtracting intermediate consumption at constant prices from output at constant prices. Double deflation is the technique used to estimate real value added of an industry. In the double deflation method, real value added is measured as the difference between real gross output and real...

2 days ago The Loksabha election 2024 will witness approximately 97 crores eligible voters exercise their democratic rights representing the world's largest elections. As a result of this scale, it also incurs huge cost. Based on previous years' trends, the 2024 election is expected to cost approximately Rs 1,20,000 crore. The US election of 2020 involved a huge cost of about 1 lakh crores. Therefore 2024 elections would become the costliest election in the world. Expenditure during 2019 Lok Sabha...

3 days ago India is experiencing fast changing geopolitics which may bring its benefits and issues before the country. USA has been describing India as one of the most important partners till 2023 but with the beginning of 2024 things have changed dramatically. First, USA urged Canada to investigate the alleged role of India in the murder of Khalistan Separatist Hardeep singh nijjar and it shields Khalistani separatist Gurpatwant singh Pannu who is an US citizen, also holding citizenship of Canada. USA has also accused India of...

May 10 Trade secrets are intellectual property rights (IPRs) that refers to any practice or process of a company that is generally not known outside of the company. In general, any confidential business information which provides an enterprise a competitive edge and is unknown to others may be protected as a trade secret. Information considered a trade secret gives the company a competitive advantage over its competitors and is often a product of internal research and development. What qualifies as a trade...

May 10 Reserve position in the IMF is the sum of 1. The Reserve Tranche and 2. Any indebtedness of the IMF 1. What is a Reserve Tranche? It is the foreign currency including Special Drawing Rights that a member country may draw from the IMF at short notice. The primary means of financing the International Monetary Fund (IMF) is through members' quotas. (Click here to fund to know how IMF is financed). Each member of the IMF is assigned a quota or a membership fee, part of which is payable in...

May 07 The month of May has so far been witnessing a fall in Sensex and Nifty together. On May 7th Sensex closed with a loss of 384 points, or 0.52 per cent, at 73,511.85 while the Nifty 50 closed 140 points, or 0.62 per cent, lower at 22,302.50. So what are the possible causes? One reason is the FIIs selling. According to the experts, the biggest reason behind the recent volatility in the Indian stock market is the strong selloff by foreign institutional investors (FIIs). Based on the last 20 years data, it can...

May 06 A hedge fund is a fund created by limited partnership of private investors whose money is pooled and managed by professional fund managers. Hedge fund is a private investment partnership and funds pool that uses varied and complex strategies and invests or trades in complex products, including listed and unlisted stocks and derivatives. These managers use a wide range of strategies to earn above-average investment returns. A hedge fund investment is often considered a risky, alternative investment choice and...

May 06 Derivatives are contracts that get their value from an underlying asset – equities, bonds, commodities, and currencies, among many. In layman terms, if the cost of raw material of a particular product increase, the price of that product will also rise. The same principle applies to derivatives. What are Currency Derivatives? Currency Derivatives are exchange-traded contracts deriving their value from their underlying asset, i.e., the currency. The investor buys or sells specific units of fixed currency on a...

May 06 A currency swap is a transaction in which two parties exchange an equivalent amount of money with each other but in different currencies. The parties are essentially loaning each other money and will repay the amounts at a specified date and exchange rate. Currency swap is a financial instrument used by companies and institutions to secure better loan rates in foreign currencies than they might be able to obtain directly in the foreign market. They involve the exchange of principal and interest payments in one currency for...

May 02 You would be familiar with Eyewear brand Lenskart. The company was founded in 2010 by Peyush Bansal and his friends Amit Chaudhary and Sumeet Kapahi with the aim of revolutionizing the eyewear industry by providing customers with high-quality, affordable eyewear. Since it was founded it has received numerous investments. In 2011, IDG Ventures India invested $4 million in the company. In January 2015, the company raised ₹135 crore from venture capitalist companies like TPG Growth, TR Capital and IDG Ventures India....

May 07 In the last many years of human civilization, modes of transport have evolved. Look at them.

May 07 Innovation is required to protect motorcyclists from injuries during accidents. This airbag is one of them.

May 06 Were these phone real or dummies?

May 05 The video presents a visual that how our back is affected when we lift weight.

May 02 Read more

May 01 Mint - The Adani Group company reported a 67% year-on-year (YoY) surge in its net profit for the March quarter (Q4 FY24), rising to ₹157 crore from ₹94 crore last year same period. Read more

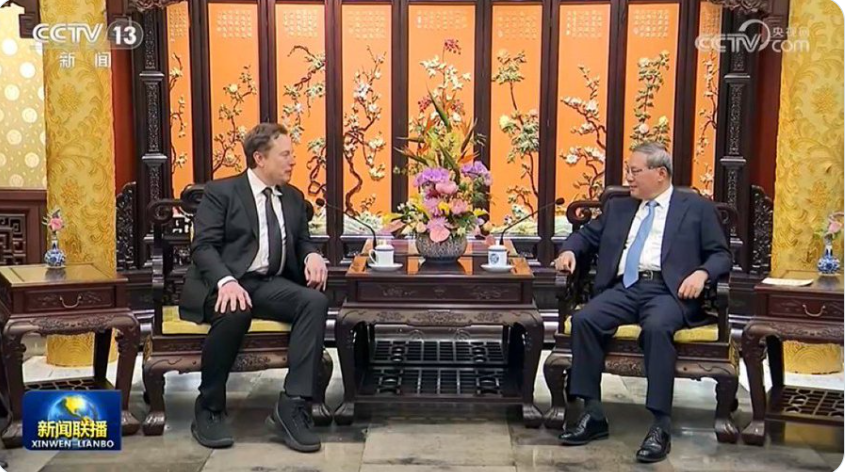

April 28 Mint - On Sunday, Tesla CEO Elon Musk posted a picture with Qiang and said, “We have known each other now for many years, since early Shanghai days.” Read more

April 25 Mint - As market cap fell making shareholders poorer by ₹39,768.36 crore, Uday Kotak holding a 29.71 per cent stake also lost ₹10,225 crore in a day. Read more

April 24 Business Standard - The Reserve Bank of India has asked private sector lender Kotak Mahindra Bank not to issue new credit cards and barred new customer onboarding through the bank’s online and mobile banking channels. Read More

April 23 Down to Earth - Out of a global workforce of 3.4 billion, over 2.4 billion workers are likely to be exposed to excessive heat at some point during their work. Read more

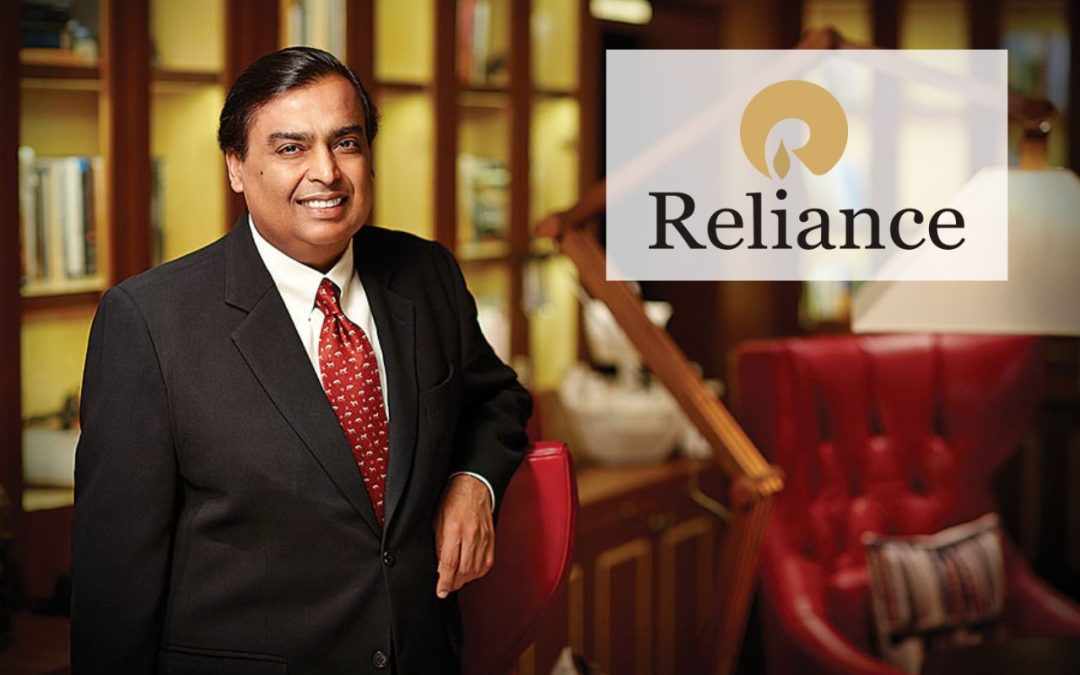

April 22 News18 - Reliance Industries Ltd (RIL) said net profit rose 0.1 percent to Rs 21,243 crore for the fiscal fourth quarter, beating analyst estimates, driven by a recovery in its core oil-to-chemicals (O2C) business. Read more

April 22 Mint - Samsung Galaxy S22 receives a massive discount on Flipkart, now priced at ₹36,999. It features OneUI 6.0, IP68 protection, and 4K selfie camera. The device runs on Snapdragon 8 Gen 1 processor and promises 4 generations of Android OS upgrades. Read more

April 18 CNN - Chaos ensued in the United Arab Emirates after the country witnessed the heaviest rainfall in 75 years, with some areas recording more than 250 mm (around 10 inches) of precipitation in fewer than 24 hours, the state’s media office said in a statement Wednesday. Read more

April 13 Moneycontrol - Nakul Nath, the son of former Madhya Pradesh chief minister Kamal Nath, is the richest candidate contesting in the first phase of the Lok Sabha election, as per Association for Democratic Reforms (ADR). Read more

April 13 Mint- Vodafone Idea will launch a follow-on public offer (FPO) worth ₹18,000 crore next week at a price band of ₹10-11 apiece. Read more

April 05 Mint - Zomato share price has surged approximately 270 per cent over the last year, and the rally of the stock can continue as experts believe the food-delivery company may report healthy Q4FY24 performance, further boosting investors' sentiment about the stock. Read More

April 03 Economic Times : In a recent update from Forbes, Mukesh Ambani, Chairman of Reliance Industries, has secured the top spot as the wealthiest individual in both Asia and India. Read more

April 02 Mint - In the latest addition, a commuter, dubbed "Spider-Man," skillfully navigates above the jam-packed seats, moving slowly above one berth to another to reach the toilet of the train to ease himself. Read more

April 01 Mint - According to stock market oBSErvers, shares of SRM Contractors Limited are available at a premium of ₹126 in the grey market today. Read more

March 29 Forbes : From hidden gems to emerging getaways, here are the top five destinations making waves this year. Read more

Comments

Write Comment