Asset tokenization is the process by which an issuer creates digital tokens of an asset such as property or financial assets like shares, funds etc.

These tokens are shared and shown to the buyer on a distributed ledger or blockchain. Blockchain guarantees that once you buy tokens representing an asset, no single authority can erase or change your ownership which means that your ownership of that asset remains entirely unchangeable unless you want.

Lets see this by an example. Suppose you have a property worth Rupees 500,000 in Bangalore, India. Asset tokenization could convert ownership of this property into 500,000 tokens with each one representing a tiny percentage (0.0002%) of the property.

Now if you need to borrow Rs 50,000. it wouldn’t make sense to sell your property, instead of selling the whole property, instead, you issue tokens on a token exchange. When someone buys a token, he/she is a share holder in that property for the percentage they have invested.

What can be tokenized?

Almost every form of asset. From traditional assets like venture capital funds, bonds, commodities, and real-estate properties to other assets like sports teams, race horses, artwork, and celebrities, companies worldwide use blockchain technology to tokenize almost anything.

What are the benefits?

One is liquidity because you can buy and sell anytime. Even properties trade takes no time. Tokenization can also help improve liquidity for historically illiquid assets like paintings.

Other is Accessibility as it is easier for everyone to invest into tokens. Then it is Transparency as it is based on blockchain technology.

Follow Zinkpot Capital on Youtube for videos

Ask Anything, Know Better

18 hours ago The month of may is filled with many IPOs. Lets have a look on them. The first is the Indegene IPO who will launch its IPO on May 6. This company helps the emerging biotech and medical device companies develop products and get them to the market. It provides digital services to the life sciences industry. The issue size is Rs 1,842-crore and the price band has been fixed at Rs 430-452 per share. The IPO closes on May 8, comprises a fresh issue of equity shares worth Rs 760 crore and an...

20 hours ago People who want to help the poor or the underprivileged always face a challenge that whom to donate to. The Social Stock Exchange (SSE) is a segment of the existing stock exchange, designed to help non-profit organizations (NPOs) and for-profit social enterprises raise funds. A social stock exchange is a platform where social enterprises/organizations can raise funds from the public who in this case can be seen as the donors. Just like equity, commodities, derivatives, and small and medium-sized enterprises...

2 days ago One always wants to pick those shares where maximum returns can be generated while minimising the risks associated. There are some steps which if followed would help you choose the best among thousands of the shares around. The first step is about determining your goals. Decide whether do you want to maximize your returns or want safety of your money. Your goals depends upon your age, financial conditions or other factors such as your risk appetite that how much risk can you take. At early ages, e.g in your...

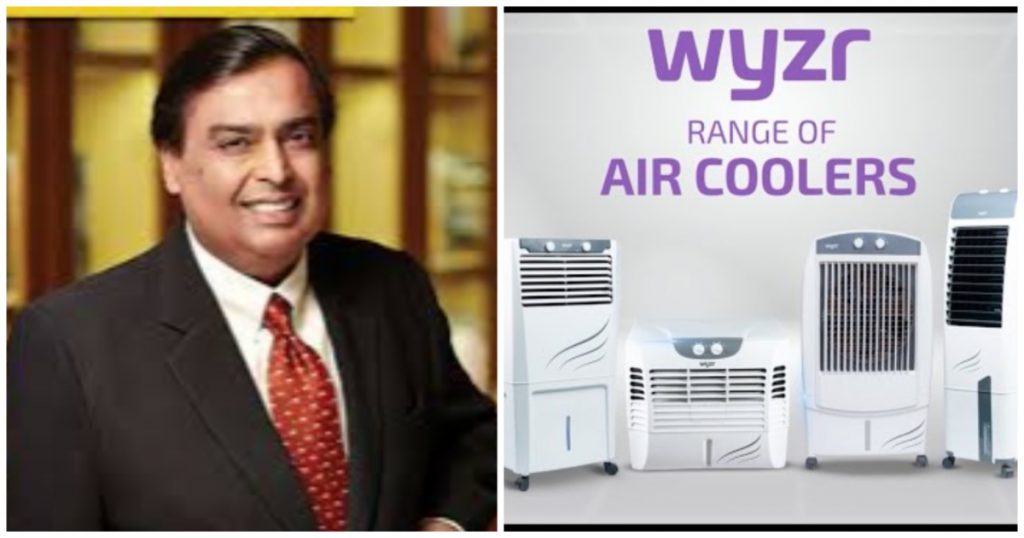

6 days ago Reliance Industries Ltd (RIL) is planning to disrupt the dominance of multinationals like Samsung, LG in the local consumer electronics and home appliances market with a new made-in-India brand Wyzr. The company is therefore finalising production agreements with domestic contract manufacturers Dixon Technologies and Onida parent Mirc Electronics. In future, the company wants to set up its own plants after the brand gains market share. Reliance has already launched Wyzr brand air coolers and plans to extend...

April 24 Inheritance is acquisition of a person's property by the close family members after the person’s death. Inheritance tax would mean a tax to be paid by those who inherit property from their parents/grand parents or other relatives. Inheritance tax is also known as estate tax, is levied on the total value of money and property of a deceased person before it is distributed to their legal heirs. The tax is typically calculated based on the value of the assets left behind. The purpose of inheritance tax is often...

April 23 The price of 10 gram (24 carat 99.9% purity) gold is approx. Rs 74,000 in April 2024 and the gold price was Rs 24,740 in 2015. So, it took 9 years for the gold prices to triple. Earlier Gold prices tripled between 2006-2015 when in this 9 year period, the prices jumped from Rs 8,250 in 2006 to 24,740 in 2015. Before this, it took almost 19 years for the gold price to triple from Rs 2,570 in 1987 to 8,250 in 2006. If we assume that the gold triples every 9 years, then gold prices per 10 gm...

April 22 Treasury bills or T-bills, are money market instruments which are short term debt instruments issued by the Government of India and are presently issued in three tenors, namely, 91 day, 182 day and 364 day. Treasury bills are zero coupon securities and pay no interest. Instead, they are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of ₹100/- (face value) may be issued at say ₹ 98.20, that is, at a discount of say, ₹1.80 and would be redeemed at the face value of...

April 21 ‘Call Money’ is the borrowing or lending of funds for 1 day. When the money is borrowed or lend for period between 2 days and 14 days it is known as ‘Notice Money’. And ‘Term Money’ refers to borrowing/lending of funds for period exceeding 14 days. Banks and Primary Dealers borrow and lend overnight or for the short period to meet their short term mismatches in fund positions. This borrowing and lending is on unsecured basis which means that no collateral in required for borrowing or lending in...

April 13 Who funds the IMF? The money the IMF lends to its members comes from member countries, mainly through their payment of quotas. However multilateral and bilateral arrangements can supplement quota funds and plays a critical role in the IMF’s support for member countries in times of crisis. IMF funds come from three sources: member quotas, multilateral and bilateral borrowing agreements. Member quotas : Member quotas are the primary source of IMF funding. A member country’s quota reflects its size and...

April 06 What is a Bond? It is a debt instrument that provides investors with a fixed income via interest payments and repays the principal amount on a pre-defined maturity date. Bonds are safe instruments free from the ups and downs of that of an equity market. Bonds are an important part of the financial market and act as a crucial source of capital for corporates and the government. What is a Bond price: It is the price at which an investor buys a bond. Coupon rate: This is the periodic interest rate paid to the...

May 01 Mint - The Adani Group company reported a 67% year-on-year (YoY) surge in its net profit for the March quarter (Q4 FY24), rising to ₹157 crore from ₹94 crore last year same period. Read more

April 28 Mint - On Sunday, Tesla CEO Elon Musk posted a picture with Qiang and said, “We have known each other now for many years, since early Shanghai days.” Read more

April 25 Mint - As market cap fell making shareholders poorer by ₹39,768.36 crore, Uday Kotak holding a 29.71 per cent stake also lost ₹10,225 crore in a day. Read more

April 24 Business Standard - The Reserve Bank of India has asked private sector lender Kotak Mahindra Bank not to issue new credit cards and barred new customer onboarding through the bank’s online and mobile banking channels. Read More

April 23 Down to Earth - Out of a global workforce of 3.4 billion, over 2.4 billion workers are likely to be exposed to excessive heat at some point during their work. Read more

April 22 News18 - Reliance Industries Ltd (RIL) said net profit rose 0.1 percent to Rs 21,243 crore for the fiscal fourth quarter, beating analyst estimates, driven by a recovery in its core oil-to-chemicals (O2C) business. Read more

April 22 Mint - Samsung Galaxy S22 receives a massive discount on Flipkart, now priced at ₹36,999. It features OneUI 6.0, IP68 protection, and 4K selfie camera. The device runs on Snapdragon 8 Gen 1 processor and promises 4 generations of Android OS upgrades. Read more

April 18 CNN - Chaos ensued in the United Arab Emirates after the country witnessed the heaviest rainfall in 75 years, with some areas recording more than 250 mm (around 10 inches) of precipitation in fewer than 24 hours, the state’s media office said in a statement Wednesday. Read more

April 13 Moneycontrol - Nakul Nath, the son of former Madhya Pradesh chief minister Kamal Nath, is the richest candidate contesting in the first phase of the Lok Sabha election, as per Association for Democratic Reforms (ADR). Read more

April 13 Mint- Vodafone Idea will launch a follow-on public offer (FPO) worth ₹18,000 crore next week at a price band of ₹10-11 apiece. Read more

April 05 Mint - Zomato share price has surged approximately 270 per cent over the last year, and the rally of the stock can continue as experts believe the food-delivery company may report healthy Q4FY24 performance, further boosting investors' sentiment about the stock. Read More

April 03 Economic Times : In a recent update from Forbes, Mukesh Ambani, Chairman of Reliance Industries, has secured the top spot as the wealthiest individual in both Asia and India. Read more

April 02 Mint - In the latest addition, a commuter, dubbed "Spider-Man," skillfully navigates above the jam-packed seats, moving slowly above one berth to another to reach the toilet of the train to ease himself. Read more

April 01 Mint - According to stock market oBSErvers, shares of SRM Contractors Limited are available at a premium of ₹126 in the grey market today. Read more

March 29 Forbes : From hidden gems to emerging getaways, here are the top five destinations making waves this year. Read more

March 27 Economic Times : The gross market borrowing of Rs 7.50 lakh crore shall be completed through 26 weekly auctions Read more

March 26 Indian Express - The United Nations Security Council on Monday demanded an immediate ceasefire between Israel and Palestinian militants Hamas and the immediate and unconditional release of all hostages after the United States abstained from the vote. Read more

March 23 India Today : A total of 115 people have so far been killed in the Moscow concert hall attack. Eleven people, including four terrorists, were arrested for the attack. Read more

March 10 CNBC - As per custom, the lemon and other items including fruits offered to Lord Shiva during the Mahasivarathiri festivities observed on Friday night at the Pazhapoosaian temple near Sivagiri village, 35 km from here, were auctioned. Read more

March 05 Apple has unveiled its latest iteration of the MacBook Air, featuring the powerful M3 chip, promising enhanced performance and functionality. The new MacBook Air boasts up to 60 percent faster performance compared to the model equipped with the M1 chip and up to 13 times faster than its Intel-based predecessor. read more

Comments

Write Comment