What is the purpose of the SDR?

The IMF created the SDR as a supplementary international reserve asset in 1969, when currencies were tied to the price of gold and the US dollar was the leading international reserve asset. The IMF defined the SDR as equivalent to that amount of gold that was equivalent to one US dollar.

When fixed exchange rates ended in 1973, the IMF redefined the SDR as equivalent to the value of a basket of world currencies.

The allocation of SDRs by IMF to its member countries is done as per the quota system prevalent in IMF mechanism. When a country joins the IMF, it is assigned an initial quota in the same range as the quotas of existing members.

This IMF quota is the weighted average of a country’s GDP, openness, economic variability and international reserves. The stronger a country’s economy, the higher quota share it has.

The allocation of SDR is also based upon the amount of contribution to the capital reserve by a country to the IMF at the time of its initiation of the membership. For example, as United States have contributed the most to the total reserve of SDR, it holds the maximum percentage in the total allocation i.e. 17.46%. India’s current quota in IMF is 2.44%.

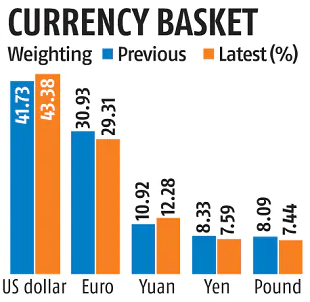

In order to determine the value of 1 SDR, IMF uses a basket of five currencies which are chosen on the basis of the amount of exports of the country and the ease of convertibility of the currency of the respective country.

Presently, the SDR basket of currencies include US Dollar, Euro, Japanese Yen, Pound Sterling and Yuan (Chinese Renminbi). Taking in account all of these, the cost of 1 Special Drawing Right in USD today is $1.33. click here for real time value.

The value of 1 SDR keeps on fluctuating based upon the spot exchange rates. The IMF reviews the SDR basket every five years.

The most recent allocation of SDRs was done In August 2021 of 456 billion SDR, which is the largest allocation ever. It was done to address the long-term global need for reserves and help countries cope with the impact of Covid-19 pandemic.

Only IMF and IMF members can hold SDRs and the IMF has the authority to approve other holders, such as central banks and multilateral development banks while individuals in private entities cannot hold SDRs.

SDR helps members to reduce their reliance on more expensive domestic or external debt for building reserves This is because the interest on SDR is a comparatively low as compared to other external debts.

To date, SDR 660.7 billion has been allocated, which is equal to approximately $943 billion.

Ask Anything, Know Better

6 days ago Reserve position in the IMF is the sum of 1. The Reserve Tranche and 2. Any indebtedness of the IMF 1. What is a Reserve Tranche? It is the foreign currency including Special Drawing Rights that a member country may draw from the IMF at short notice. The primary means of financing the International Monetary Fund (IMF) is through members' quotas. (Click here to fund to know how IMF is financed). Each member of the IMF is assigned a quota or a membership fee, part of which is payable in...

May 06 Derivatives are contracts that get their value from an underlying asset – equities, bonds, commodities, and currencies, among many. In layman terms, if the cost of raw material of a particular product increase, the price of that product will also rise. The same principle applies to derivatives. What are Currency Derivatives? Currency Derivatives are exchange-traded contracts deriving their value from their underlying asset, i.e., the currency. The investor buys or sells specific units of fixed currency on a...

April 25 Mint - As market cap fell making shareholders poorer by ₹39,768.36 crore, Uday Kotak holding a 29.71 per cent stake also lost ₹10,225 crore in a day. Read more

April 24 Business Standard - The Reserve Bank of India has asked private sector lender Kotak Mahindra Bank not to issue new credit cards and barred new customer onboarding through the bank’s online and mobile banking channels. Read More

April 21 ‘Call Money’ is the borrowing or lending of funds for 1 day. When the money is borrowed or lend for period between 2 days and 14 days it is known as ‘Notice Money’. And ‘Term Money’ refers to borrowing/lending of funds for period exceeding 14 days. Banks and Primary Dealers borrow and lend overnight or for the short period to meet their short term mismatches in fund positions. This borrowing and lending is on unsecured basis which means that no collateral in required for borrowing or lending in...

April 13 Who funds the IMF? The money the IMF lends to its members comes from member countries, mainly through their payment of quotas. However multilateral and bilateral arrangements can supplement quota funds and plays a critical role in the IMF’s support for member countries in times of crisis. IMF funds come from three sources: member quotas, multilateral and bilateral borrowing agreements. Member quotas : Member quotas are the primary source of IMF funding. A member country’s quota reflects its size and...

April 02 The Indian rupee has been the legal tender in the Gulf countries, including Kuwait, Bahrain, Qatar and UAE, till the early 1970s. In 1959, the Centre allowed the RBI to issue special notes only for the Gulf region. The currency had the same value as the Indian rupee and was known as the Gulf rupee or external rupee. Indians could also take the Indian rupee notes when they went on the Haj pilgrimage and exchange them freely for Saudi riyals. Later, the Centre introduced special notes for the pilgrimage with the word "HAJ"...

April 01 RBI एक गैर-लाभकारी संस्था है, फिर उसने 2.3 लाख करोड़ का मुनाफ़ा कैसे कमाया?

February 15 The Emerging Markets (EM) Index is a significant benchmark used to track the performance of local-currency-denominated Sovereign Bonds issued by emerging market countries. The EM Index is designed to provide investors with a representative measure of the fixed-income market within emerging market economies. It includes government bonds issued by various emerging market countries, and its composition may change over time based on eligibility criteria. One of the widely followed indices for emerging markets is the MSCI Emerging...

November 27 A cooperative bank is a financial institution that is owned and controlled by a group of people who are also customers of the bank. These banks follow the cooperative principle of one person, one vote, and provide services such as savings and loans to both members and non-members. Cooperative banks in India are regulated by the Reserve Bank of India through Banking regulation act 1949 and Banking laws (cooperative society) act 1955 and are registered under the States Cooperative Societies Act. Cooperative...

May 07 In the last many years of human civilization, modes of transport have evolved. Look at them.

May 07 Innovation is required to protect motorcyclists from injuries during accidents. This airbag is one of them.

May 06 Were these phone real or dummies?

May 05 The video presents a visual that how our back is affected when we lift weight.

May 02 Read more

May 01 Mint - The Adani Group company reported a 67% year-on-year (YoY) surge in its net profit for the March quarter (Q4 FY24), rising to ₹157 crore from ₹94 crore last year same period. Read more

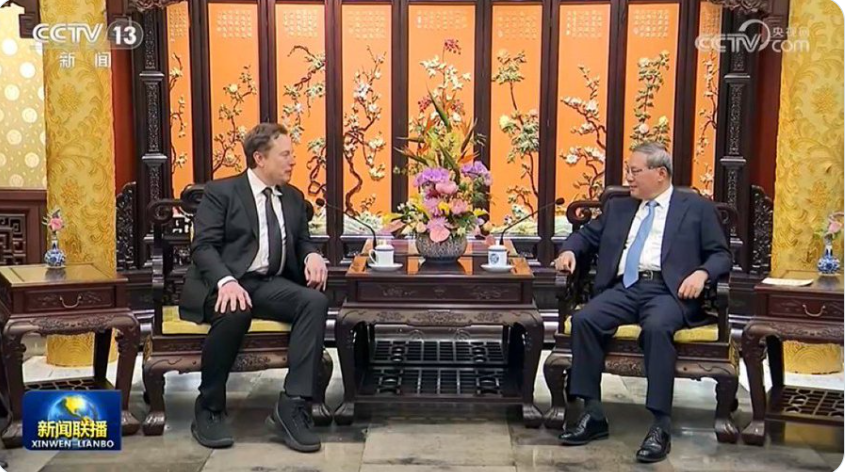

April 28 Mint - On Sunday, Tesla CEO Elon Musk posted a picture with Qiang and said, “We have known each other now for many years, since early Shanghai days.” Read more

April 25 Mint - As market cap fell making shareholders poorer by ₹39,768.36 crore, Uday Kotak holding a 29.71 per cent stake also lost ₹10,225 crore in a day. Read more

April 24 Business Standard - The Reserve Bank of India has asked private sector lender Kotak Mahindra Bank not to issue new credit cards and barred new customer onboarding through the bank’s online and mobile banking channels. Read More

April 23 Down to Earth - Out of a global workforce of 3.4 billion, over 2.4 billion workers are likely to be exposed to excessive heat at some point during their work. Read more

April 22 News18 - Reliance Industries Ltd (RIL) said net profit rose 0.1 percent to Rs 21,243 crore for the fiscal fourth quarter, beating analyst estimates, driven by a recovery in its core oil-to-chemicals (O2C) business. Read more

April 22 Mint - Samsung Galaxy S22 receives a massive discount on Flipkart, now priced at ₹36,999. It features OneUI 6.0, IP68 protection, and 4K selfie camera. The device runs on Snapdragon 8 Gen 1 processor and promises 4 generations of Android OS upgrades. Read more

April 18 CNN - Chaos ensued in the United Arab Emirates after the country witnessed the heaviest rainfall in 75 years, with some areas recording more than 250 mm (around 10 inches) of precipitation in fewer than 24 hours, the state’s media office said in a statement Wednesday. Read more

April 13 Moneycontrol - Nakul Nath, the son of former Madhya Pradesh chief minister Kamal Nath, is the richest candidate contesting in the first phase of the Lok Sabha election, as per Association for Democratic Reforms (ADR). Read more

April 13 Mint- Vodafone Idea will launch a follow-on public offer (FPO) worth ₹18,000 crore next week at a price band of ₹10-11 apiece. Read more

April 05 Mint - Zomato share price has surged approximately 270 per cent over the last year, and the rally of the stock can continue as experts believe the food-delivery company may report healthy Q4FY24 performance, further boosting investors' sentiment about the stock. Read More

April 03 Economic Times : In a recent update from Forbes, Mukesh Ambani, Chairman of Reliance Industries, has secured the top spot as the wealthiest individual in both Asia and India. Read more

April 02 Mint - In the latest addition, a commuter, dubbed "Spider-Man," skillfully navigates above the jam-packed seats, moving slowly above one berth to another to reach the toilet of the train to ease himself. Read more

April 01 Mint - According to stock market oBSErvers, shares of SRM Contractors Limited are available at a premium of ₹126 in the grey market today. Read more

March 29 Forbes : From hidden gems to emerging getaways, here are the top five destinations making waves this year. Read more

Comments

Write Comment