Ask Anything, Know Better

May 06 Derivatives are contracts that get their value from an underlying asset – equities, bonds, commodities, and currencies, among many. In layman terms, if the cost of raw material of a particular product increase, the price of that product will also rise. The same principle applies to derivatives. What are Currency Derivatives? Currency Derivatives are exchange-traded contracts deriving their value from their underlying asset, i.e., the currency. The investor buys or sells specific units of fixed currency on a...

April 02 The Indian rupee has been the legal tender in the Gulf countries, including Kuwait, Bahrain, Qatar and UAE, till the early 1970s. In 1959, the Centre allowed the RBI to issue special notes only for the Gulf region. The currency had the same value as the Indian rupee and was known as the Gulf rupee or external rupee. Indians could also take the Indian rupee notes when they went on the Haj pilgrimage and exchange them freely for Saudi riyals. Later, the Centre introduced special notes for the pilgrimage with the word "HAJ"...

April 01 RBI एक गैर-लाभकारी संस्था है, फिर उसने 2.3 लाख करोड़ का मुनाफ़ा कैसे कमाया?

February 16 A carbon tax is a type of environmental policy that imposes a fee on greenhouse gas (GHG) emissions, typically measured in units of carbon dioxide (CO₂) or carbon content of fossil fuels. The tax is designed to discourage the production and use of fossil fuels, thereby reducing GHG emissions and mitigating the effects of climate change. The fundamental idea behind a carbon tax is to internalize the external costs associated with climate change and encourage the adoption of cleaner and more sustainable practices. Here are the key...

July 03 What is the SDR? The SDR is an international reserve asset. The SDR itself is not a currency but an asset that holders can exchange for currency when needed. The SDR serves as the unit of account of the IMF and other international organizations. Special Drawing Rights (SDR) was created by the International Monetary Fund in 1969. The SDR serves as the unit of account of the IMF.Though it is not a real currency, it is just a unit of account. What is the purpose of the SDR? The IMF created the SDR as a...

February 17 Dainik Bhaskar - भारतीय मूल के नील मोहन को YouTube का नया CEO बनाया गया है। इससे पहले नील मोहन यूट्यूब के CPO थे। उन्हें प्रमोट कर ये जिम्मेदारी दी गई है। नील मोहन Google के साथ 2008 से काम कर रहे हैं। साल 2013 में कंपनी ने उन्हें 544 करोड़...

May 07 In the last many years of human civilization, modes of transport have evolved. Look at them.

May 07 Innovation is required to protect motorcyclists from injuries during accidents. This airbag is one of them.

May 06 Were these phone real or dummies?

May 05 The video presents a visual that how our back is affected when we lift weight.

May 02 Read more

May 01 Mint - The Adani Group company reported a 67% year-on-year (YoY) surge in its net profit for the March quarter (Q4 FY24), rising to ₹157 crore from ₹94 crore last year same period. Read more

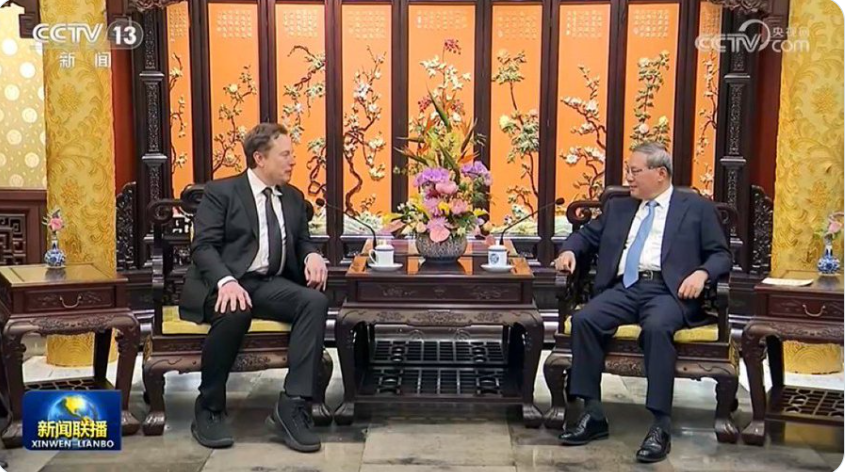

April 28 Mint - On Sunday, Tesla CEO Elon Musk posted a picture with Qiang and said, “We have known each other now for many years, since early Shanghai days.” Read more

April 25 Mint - As market cap fell making shareholders poorer by ₹39,768.36 crore, Uday Kotak holding a 29.71 per cent stake also lost ₹10,225 crore in a day. Read more

April 24 Business Standard - The Reserve Bank of India has asked private sector lender Kotak Mahindra Bank not to issue new credit cards and barred new customer onboarding through the bank’s online and mobile banking channels. Read More

April 23 Down to Earth - Out of a global workforce of 3.4 billion, over 2.4 billion workers are likely to be exposed to excessive heat at some point during their work. Read more

April 22 News18 - Reliance Industries Ltd (RIL) said net profit rose 0.1 percent to Rs 21,243 crore for the fiscal fourth quarter, beating analyst estimates, driven by a recovery in its core oil-to-chemicals (O2C) business. Read more

April 22 Mint - Samsung Galaxy S22 receives a massive discount on Flipkart, now priced at ₹36,999. It features OneUI 6.0, IP68 protection, and 4K selfie camera. The device runs on Snapdragon 8 Gen 1 processor and promises 4 generations of Android OS upgrades. Read more

April 18 CNN - Chaos ensued in the United Arab Emirates after the country witnessed the heaviest rainfall in 75 years, with some areas recording more than 250 mm (around 10 inches) of precipitation in fewer than 24 hours, the state’s media office said in a statement Wednesday. Read more

April 13 Moneycontrol - Nakul Nath, the son of former Madhya Pradesh chief minister Kamal Nath, is the richest candidate contesting in the first phase of the Lok Sabha election, as per Association for Democratic Reforms (ADR). Read more

April 13 Mint- Vodafone Idea will launch a follow-on public offer (FPO) worth ₹18,000 crore next week at a price band of ₹10-11 apiece. Read more

April 05 Mint - Zomato share price has surged approximately 270 per cent over the last year, and the rally of the stock can continue as experts believe the food-delivery company may report healthy Q4FY24 performance, further boosting investors' sentiment about the stock. Read More

April 03 Economic Times : In a recent update from Forbes, Mukesh Ambani, Chairman of Reliance Industries, has secured the top spot as the wealthiest individual in both Asia and India. Read more

April 02 Mint - In the latest addition, a commuter, dubbed "Spider-Man," skillfully navigates above the jam-packed seats, moving slowly above one berth to another to reach the toilet of the train to ease himself. Read more

April 01 Mint - According to stock market oBSErvers, shares of SRM Contractors Limited are available at a premium of ₹126 in the grey market today. Read more

March 29 Forbes : From hidden gems to emerging getaways, here are the top five destinations making waves this year. Read more

Comments

Write Comment