WHAT?

The Fiscal Responsibility and Budget Management (FRBM) Act, 2003 is a legislation enacted by the Indian Parliament to ensure fiscal discipline, improve macroeconomic stability, and reduce the fiscal deficit of the central government over time.

Key Fiscal Challenges Before FRBM

- India’s fiscal deficit (central government) averaged 6.5% of GDP in the 1990s, peaking at 6.5% in 2001–02. A high fiscal deficit meant heavy borrowing from the market, which crowded out private investment, increased interest burden and reduced government capacity to invest in infrastructure or social development

- In 1990–91, revenue deficit was 2.5% of GDP. By 2001–02, it reached 4.4% of GDP. Borrowing was being used to fund consumption (like salaries and subsidies), not investment—violating basic principles of fiscal prudence.

- In 2001–02, interest payments accounted for 47% of revenue receipts. Total public debt stood at over 70% of GDP (Centre + States). India was entering a debt trap which means borrowing to pay interest on past debt.

- After the 1991 balance of payments crisis, IMF and World Bank emphasized fiscal discipline. India’s growing ambition in global markets required a stable, credible fiscal framework

- Many state governments were running fiscal deficits >5% of their GSDP. In some states, salary arrears and borrowing for current expenditure created solvency risks. To address all these challenges, FRBM act was enacted.

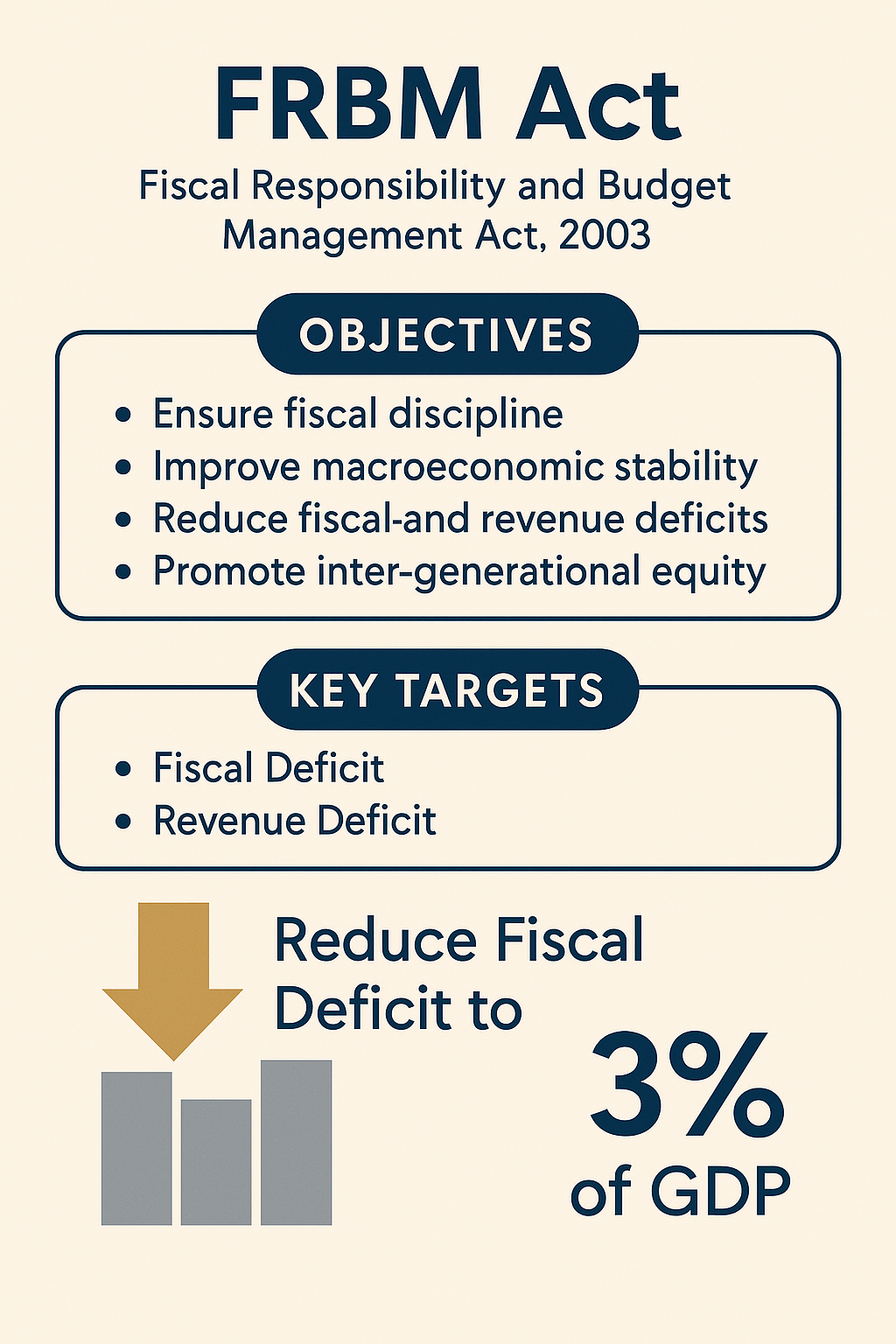

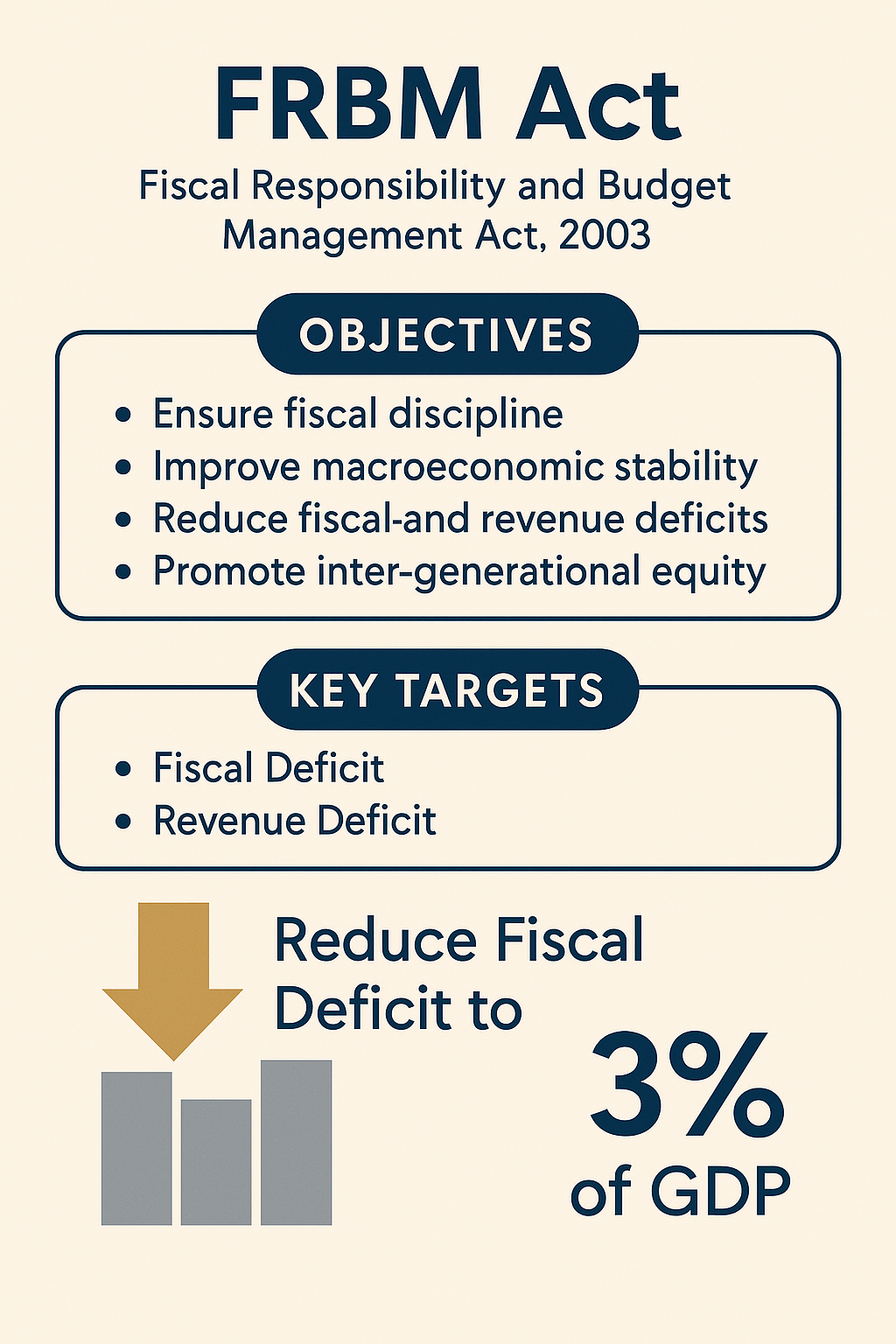

Objectives of the FRBM Act

- Institutionalize financial discipline

- Improve transparency in fiscal operations

- Reduce fiscal and revenue deficits

- Ensure long-term macroeconomic stability

- Enable inter-generational equity in fiscal management

Key Provisions

| Provision |

Details |

| Targets (original) |

Fiscal Deficit to be reduced to 3% of GDP, Revenue Deficit to be eliminated |

| Annual Reduction Goals |

Gradual reduction in deficits as per medium-term fiscal policy statements |

| Transparency Measures |

Mandatory quarterly reviews, disclosures, and presentation of three fiscal documents in Parliament |

| Borrowing Limit |

Limits imposed on government borrowing and debt accumulation |

| Escape Clause |

Allows deviations in case of natural disasters, national security, or structural reforms |

Three Key Fiscal Documents Presented with Budget (as per FRBM)

- Medium-Term Fiscal Policy Statement (MTFPS)

- Fiscal Policy Strategy Statement (FPSS)

- Macro-Economic Framework Statement (MEFS)

Amendments & Evolution

- 2008: Targets suspended temporarily due to global financial crisis

- 2012 Amendment: Introduced the concept of Effective Revenue Deficit

- 2018 N.K. Singh Committee recommended:

- Debt-to-GDP ratio of 40% for Centre, 20% for States by 2023

- Fiscal deficit target of 2.5% of GDP

- Creation of Fiscal Council (independent oversight body)

Comments

Write Comment