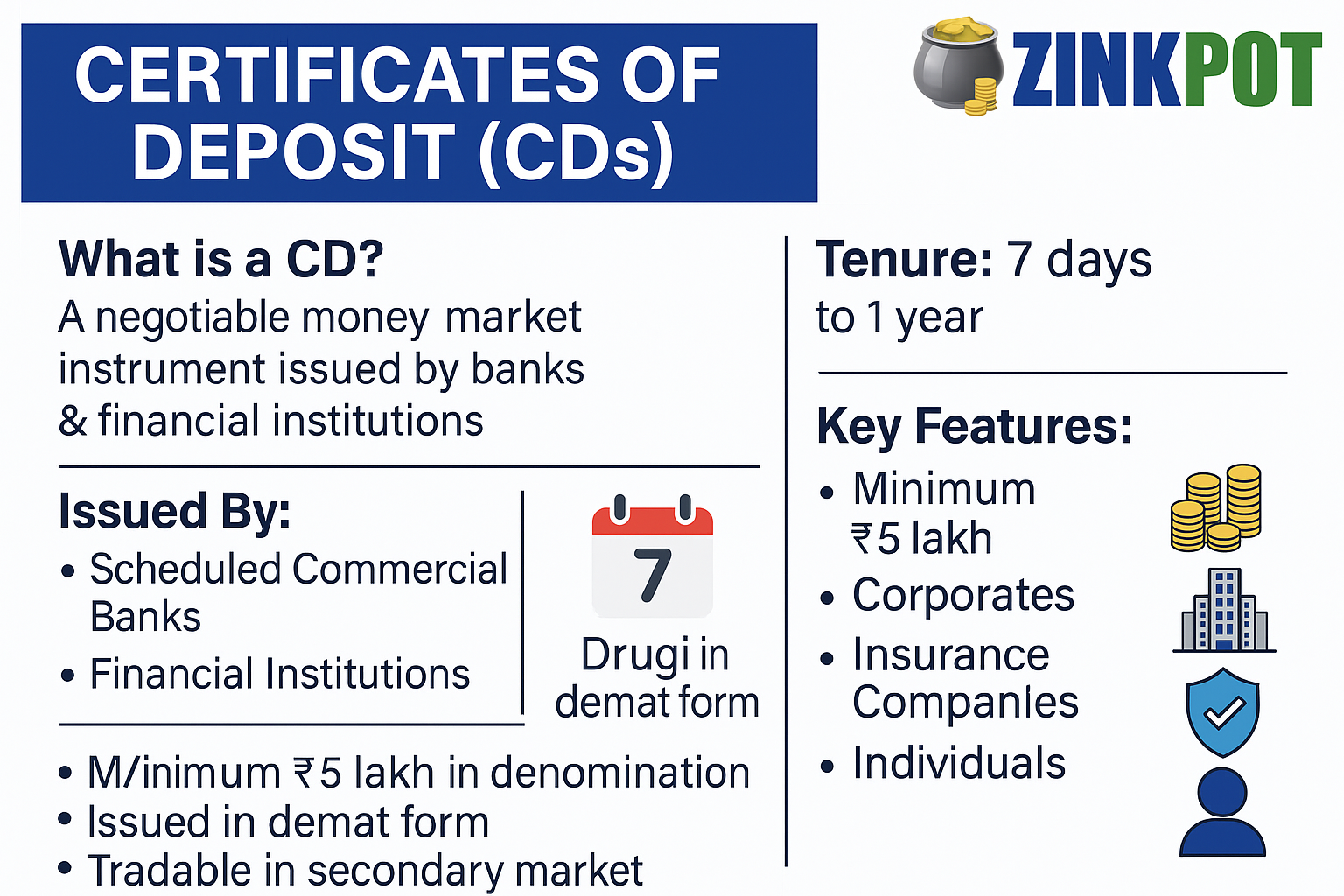

A Certificate of Deposit (CD) is a negotiable money market instrument issued by banks and financial institutions to raise short-term funds from investors at a fixed interest rate and for a fixed maturity period. It is similar to a fixed deposit but tradable, especially in the institutional money market.

| Issuer | Regulator |

|---|---|

| Scheduled Commercial Banks | RBI |

| Select Financial Institutions (e.g. SIDBI, NABARD) | RBI |

| Feature | Description |

|---|---|

| Denomination | Minimum ₹5 lakh and multiples thereof |

| Form | Issued in dematerialized (Demat) form |

| Tradability | Yes – OTC or NDS-OM platform |

| Interest Type | Discounted (zero-coupon) or coupon-based |

| Transferability | Freely transferable before maturity |

| Stamp Duty | Applicable as per Indian Stamp Act |

| Market | Platform |

|---|---|

| Primary Market | Direct placement via brokers |

| Secondary Market | Over-the-counter (OTC), NDS-OM |

| Settlement | Clearing Corporation of India Ltd (CCIL) |

| Risk Type | Details |

|---|---|

| Liquidity Risk | May not find buyers in secondary market easily |

| Interest Rate Risk | Value fluctuates with market interest rates |

| Credit Risk | Minimal for CDs from strong banks (but exists) |

| Attribute | Detail |

|---|---|

| Instrument Type | Money market, short-term debt |

| Issued By | Banks, financial institutions |

| Tradable | Yes (unlike fixed deposits) |

| Purpose | Short-term fundraising tool |

| Investors | Institutional and large retail |

Comments

Write Comment